The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has been introduced with an overarching theme of "Sabka Vikas"—development for all. But when it comes to the real estate sector, the big question is: Is this really 'Sabka Vikas,' or just another set of ambitious promises?

It’s normal to get swayed away by big Union Budget announcements, especially when it promises to boost housing demand and urban development. But let’s be real—real estate is no simple game. Affordable housing has been a challenge for years and for many, the dream of owning a home is still just that—a dream. So, while there’s talk of huge funding and new schemes, let’s see if these measures actually have the potential to make a dent or if they are just another set of “good intentions” that won’t reach the masses again.

What Union Budget 2025 Holds for Real Estate: Key Announcements

Real estate is always a hot topic and this year, all eyes were on what it’ll mean for stakeholders - homebuyers, developers, and investors. I mean, the market reaction speaks for itself where shares of real estate companies saw a nice uptick right after the budget was announced. The Nifty realty index jumped 3.3% with big names like Prestige Estates, DLF, and Sobha climbing between 2% and 6%.

It’s clear that investors are hoping the Union Budget 2025 could give the residential housing market the shot in the arm it desperately needs. So, let’s break down what’s actually been announced and explore what it could mean for the future of homeownership in India.

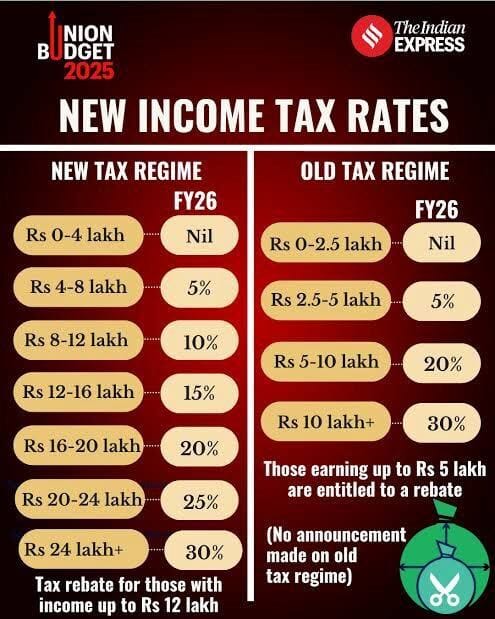

New Income Tax Slab & Rates

The government has raised the income tax exemption limit to ₹12 lakh under the new tax regime. In simpler terms, if your income is below this limit, you get to keep all your hard-earned money—no income tax deductions!

Let me tell you, this move is a big deal for homebuyers. With more disposable income in hand, people will feel more confident in investing in real estate, whether it’s buying their first home or upgrading to a bigger one. In the long run, this is definitely going to push up demand in the residential housing market, especially for those in the affordable and mid-range price brackets.

‘Nil Annual Value’ Rule

Let’s say you’ve got two homes—one you live in and maybe another one that’s a vacation spot for your family. Before, the government would tax you on that second property, even if you weren’t renting it out.

Well, good news—things have changed! Now, you can own two homes and the government won’t tax you on the second one.

This change is a rather big deal for people who were holding back on buying that second home because of the extra tax burden. And let’s be honest, this change simplifies things a lot. No more figuring out complicated tax calculations or having to justify why you’re not renting out your second home. Everyone benefits from this move, whether you’re an end-user or an investor.

SWAMIH Fund 2

SWAMIH Fund 2, under the Union Budget 2025 is here with a huge ₹15,000 crore investment and it’s set to make a big difference for homebuyers. This fund is specifically planned to complete about 1 lakh stalled housing units across the country.

This move will not only help finish these projects but will also bring a much-needed supply of ready-to-move-in homes. For homebuyers, this means a faster path to owning a space as they won’t have to wait for long completion timelines. For developers, it reduces the financial strain of incomplete projects, which makes it easier to bring them to market.

All in all, this will give a much-needed push to the residential market, reduce project delays and ensure homebuyers aren’t stuck in limbo anymore.

Increased Limit for TDS on Rent

Whether you're a tenant paying a big chunk of your salary every month or a landlord relying on rental income, this change in the Union budget brings relief on the compliance front.

So, what’s TDS all about?

TDS stands for Tax Deducted at Source. It means that when your rent crosses a certain limit, tenants have to deduct some money as tax and pay it to the government on behalf of the landlord. It helps the government collect taxes and prevent tax evasion.

Here’s the Big Change:

Earlier, TDS was applicable if your rent went over ₹2.4 lakh a year. But now, the government has increased the limit to ₹6 lakh a year! This means tenants paying up to ₹50,000 per month no longer have to deduct and deposit TDS.

Who Benefits & How?

✅ For Tenants – This doesn’t provide a financial benefit but reduces compliance hassles. Tenants paying up to ₹50,000 per month no longer need to deduct TDS, which makes rent payments simpler and eliminates the burden of tax filings.

✅ For Landlords – Landlords no longer have to depend on tenants to deduct and deposit TDS correctly. This means quicker access to full rental income without delays or complications in claiming TDS credits.

FDI: Insurance and Real Estate

The Union Budget 2025 has hiked the Foreign Direct Investment (FDI) limit for the insurance sector to 100%. This means foreign investors can own a larger stake in Indian insurance companies. Now, you might be wondering, "What does this have to do with real estate?" Well, it's all about the flow of money and economic activity.

Here's how it works:

- Increased Investment: With a higher FDI limit, more foreign capital is expected to flow into the insurance sector. This means insurance companies will have more funds to invest.

- Real Estate as an Investment: Insurance companies often invest a significant portion of their funds in real estate. This is because real estate is considered a relatively stable and long-term investment, especially in a growing economy like India.

- Boost for Real Estate: As insurance companies invest more in real estate, it can boost demand for both residential and commercial properties. This will lead to increased property values and encourage further development.

Urban Challenge Fund

The Union Budget 2025 has allocated ₹1 lakh crore to the Urban Challenge Fund for improving urban infrastructure across the country. The government will cover 25% of costs for eligible projects, but here's the catch: at least half the funding needs to come from bonds, bank loans, or PPPs.

So, what does this mean to homebuyers like you? Well, if everything clicks into place, it’s a major win for city planning and municipal services. Better infrastructure will give a major boost to real estate development.

And guess what? Bengaluru is in for a treat too! The ₹7,564 crore earmarked for railway projects in Karnataka, plus a ₹350 crore allocation for the Bengaluru Suburban Rail Project, is only going to make the city more connected and convenient to live in. Expect a lot more people looking to settle here—meaning more homes and more residential growth.

Conditions apply: Though only if the promises are actually fulfilled this time.

Commercial Real Estate through GCCs

The government’s plan to develop a national guidance framework for Global Capability Centres (GCCs) is set to transform commercial real estate, especially in tier-2 and tier-3 cities. GCCs, which are offshore units of multinational companies handling IT, R&D, and business operations, have traditionally been concentrated in metro cities. But with this new framework, cities will see a surge in demand for office spaces, co-working hubs, and business parks.

So, what does this mean for commercial real estate?

➡️ Increased Foreign Investment: With global companies expanding their operations beyond metros, commercial spaces in tier-2 and tier-3 cities will become prime real estate hotspots. Developers will have new opportunities to build office complexes, tech parks, and innovation hubs to meet the needs of international firms.

➡️ Affordable Business Expansion: Companies looking for cost-effective office spaces will now have options beyond Bangalore, Hyderabad, or Pune. This will spread real estate growth more evenly across the country, reducing congestion in metro cities while boosting infrastructure and commercial hubs in smaller cities.

➡️ Rising Demand for Residential Real Estate: A growing workforce means increased demand for homes close to these new office spaces, which will again benefit both commercial and residential real estate in these emerging markets.

UDAN Scheme

The UDAN scheme, short for "Ude Desh ka Aam Naagrik" (Let the common man fly), is all about making air travel more accessible and affordable for people in smaller cities and towns. The revamped scheme under the Union Budget 2025 aims to connect 120 new destinations and support smaller airports and helipads in less developed regions.

Now, here's how this impacts real estate:

- Opening Up New Markets: A previously isolated town getting connected to major cities by air. This opens up a whole new world of opportunities for businesses, investors and even tourists.

- Tourism Takes Flight: The UDAN scheme also aims to boost tourism in smaller cities and towns, which will lead to increased demand for hotels, resorts, and other tourism-related infrastructure.

- Infrastructure Development: The development of new airports and the expansion of existing ones will also create opportunities for real estate development in the surrounding areas. This could include the development of airport cities, logistics hubs, and other commercial and residential projects.

In simpler terms: The UDAN scheme is like building a bridge to connect previously isolated areas to the mainstream economy. This bridge brings in people, businesses, and investment, which ultimately leads to a boom in the real estate market.

Well, folks, there you have it!

The Union Budget 2025 has certainly dropped some heavy promises and while it’s got everyone buzzing, we all know that in real estate, it’s not just about the announcements but the follow-through.

But will this be the "big bang" that finally propels the market to new heights or will it fizzle out like a damp firecracker? Only time will tell!

One thing’s for sure—these changes have set the stage for some exciting opportunities. Whether it’s investing in your dream home, expanding your property portfolio, or looking to make smart commercial investments, the ball’s in your court now.

So, why wait? If you’ve been holding off on making that next move, now’s the time to take action. Propsoch is here to ensure you make the right decisions with expert insights, in-depth research, and personalized guidance every step of the way!

✅ Looking for the best properties? Our Guided Homebuying Service takes the guesswork out of the process.

✅ Need a detailed property analysis? With Propsoch Peace of Mind (POM) Report, you’ll receive an in-depth review of your chosen property, covering 80+ key factors—from legal clearances and construction quality to environmental risks and future growth potential.

Get in touch today and take the next step toward intelligent homebuying.

📊 Read Propsoch sample POM Report

📱 Follow us for real-time updates: Instagram | LinkedIn | WhatsApp Community

Your next big investment is just one smart decision away. Let’s make it happen!