Buying a home, especially if it’s your first home, or a place you’ll be living in, is a big deal. It’s likely this will be one of the bigger decisions you take in your life. There’s a lot of literature out there about home buying, but this resource is a dense write up on how you should go about the entire process - right from checking if you’re ready, to legal due diligence and closing on a property. So let’s jump into it.

Are You Ready?

I actually think this is one of the most important questions to answer, before you choose to become a homeowner. Home ownership is a long term commitment, and will affect how you live your life today, tomorrow, years down the line as well. So it’s important to ask yourself if you’re ready for these changes and commitment. I think there are 3 considerations here:

- Why are you buying a home?

- Financial Preparedness

- Psychological commitment & Life Fit

Before we dive into each of these, I must point out that there are no right or wrong answers, but there are guidelines which, if followed, can take you down the right path.

Purpose of Buying a Home

Understanding why you’re buying a home can clarify your approach and guide your decisions. The process looks very different depending on whether the goal is to live in the home or to treat it purely as an investment.

1) Buying to Live In

- Prioritizing Personal Needs and Comfort: When you’re buying a home to live in, every decision should reflect your lifestyle, comfort, and day-to-day needs. For instance, I wanted a home close to cultural and social spots. Living in the heart of the city was essential because I enjoy easy access to restaurants, parks, and events. I prioritized a neighborhood with a strong community feel and quick commutes to places I visit frequently.

- Focusing on Long-Term Suitability: Think about where you’ll be in 5, 10, or 15 years. I found myself asking: Will this house still fit my needs if my family grows? Will my commute stay manageable if I switch jobs? I also considered proximity to schools, medical facilities, and recreational spaces because, when you’re living in the home, these aspects influence your quality of life every day.

- Emotional Investment: When you’re buying to live, emotions are undeniably part of the process. It’s about finding a place that feels like home, not just a financial asset. When I chose my house, I made decisions that might not have made the best "financial" sense, like opting for a slightly more expensive property because it had the right vibe and the sunlight I wanted. Sometimes, you’re paying for that emotional connection.

2) Buying for Investment

- Focus on Market Growth and Resale Potential: When buying purely as an investment, your considerations shift. You’re not thinking about whether the home “feels right” but rather about metrics: location, demand, rental yield, and potential appreciation. For example, if I’m buying an investment property in Bangalore, I’d look at high-demand neighborhoods where rental yields are steady. Areas near tech parks or educational institutions, like Whitefield or Electronic City, often see sustained demand from professionals and students.

- Practicality Over Personal Preference: Investment properties need to appeal to a broad audience, so personal preferences take a backseat. I might prefer city-center locations, but for an investment, I’m willing to consider areas farther out where property prices are lower, but development potential is high. The idea is to think of what the market wants, not just what you’d want for yourself.

- Calculating the Numbers: With an investment property, every decision is a financial one. I looked at properties where the down payment was manageable, and the EMI could be offset by rental income. The key is making sure that the rental yield and property appreciation projections justify the costs. For instance, if I expect an annual appreciation of 5% and rental yields of 3-4%, that property could meet my financial goals, even if it’s not somewhere I’d personally want to live.

- Exit Strategy: Investment properties should come with a plan for when and how you’ll sell. I bought an apartment in a developing area once with the intention of selling within 5-7 years, once nearby infrastructure projects were completed. Having that clear timeline prevented me from getting too attached or making costly upgrades that wouldn’t increase the property’s value.

Financial Preparedness

Home buying is a long term financial commitment. Here’s what you should think about to check if you’re prepared for the same:

- Post Tax Income Today: This could be your income alone, or the household income (you could be a dual/ multiple income household). Ask yourself if the sum of this income is enough to sustain the household, and also buy a home. This is a Yes/ No question. If the answer to this question is yes, then let’s look at a few more financial considerations:

- Do You Have Your Basics Covered: This includes your emergency fund, term insurance and medical insurance. Are you in a position to augment your emergency fund, so as to cover your EMIs. Does your medical insurance cover provide enough coverage to account for most one-off medical expenses?

- Your Expenses will change as you go along: This is not only about inflation. If you plan on starting a family, consider your child’s expenses. If you have ageing parents, consider how long their streams of income will continue for, and what will be their expenses going ahead. Keep in mind that medical inflation is higher than retail inflation.

- Income stability: Jobs are not as stable as they used to be. The news has been populated with layoff stories over the last few years. Think about how stable your sources of income are. If instability exists, can you account for the same in your emergency fund? You could build some cushion into your emergency corpus to payout EMIs, while you search for another job.

- Your income will also change: It’s not all about expenses. Do keep in mind that your income will also change as you go ahead in life. In most cases, you will see a gradual increase in income YoY. In all likelihood, this will beat inflation. It’s best to factor in inflation adjust income gains. So you’re covered for your current standard of living going ahead.

- Can you cover the down-payment: Most builders will expect that you cover between 20-30% of the sale amount via a downpayment. Do you have that in place?

- Can you sustain EMIs: A good thumb rule is that the EMI amount should be less than or equal to 30% of your total income.

- What do you plan to do with the house: If you plan to put it up on rent, assess when you may be able to do so - is it a ready property? How long will it take to complete? This rental income will help with your EMI repayments too.

What not to do: Don’t stretch yourself thin. If you have a monthly savings cushion of ₹80,000, don’t put yourself in a position where you’re paying an EMI of ₹80,000. Build in some buffer for unforeseen expenses. Remember you want to continue living and enjoying your life in your new home.

Psychological Commitment & Life Fit

If you look at your life like a puzzle, home ownership is one puzzle piece. If you try to force fit that piece into your life, that puzzle won’t be complete, and likely leave gaps in other parts of the puzzle. You need to find the right piece, and position it correctly. Here are things to consider:

1) Location and Mobility

- Are you ready to stay in this location: Think realistically about your commitment to this city or neighborhood. Is it a place you see yourself in for the next several years? If you feel bound by location, homeownership can feel limiting rather than liberating. Ensure you're comfortable with the area’s vibe, amenities, and what it means for your future.

- If this is an investment, do you have local support? Distance makes maintaining a property harder, especially if you’re not close enough to handle issues firsthand. Do you have family or friends nearby who could help out if you’re not available? For instance, buying near family can be practical, as they may step in when minor or urgent needs arise.

- Are you familiar with the area’s lifestyle and culture? Each neighbourhood comes with its own lifestyle. In Bangalore, for example, Indiranagar and Jayanagar have vibrant creative and social hubs, while Whitefield is quieter. Being central, areas around Cubbon Park offer easy access to cultural events and nature. Think about whether the area aligns with your interests and personality.

- Does the location suit your work and social commute? Your work or lifestyle needs may change, so it’s essential to think ahead. If you’re currently working from home, consider if a future job or role change might require commuting. Some people don’t mind weekday commutes but want to live near city hubs to be close to social activities. Understanding your commute tolerance can help you avoid location regret.

- Is this location convenient for your family’s needs? Consider the needs of any family members who will be living with you. Think about proximity to schools, medical facilities, parks, or activities for children or elderly parents. When buying for a family, the property’s value often lies in how well it supports everyone’s lifestyle.

2) Maintaining the House

Are you prepared for the maintenance commitment? Homeownership comes with a long list of maintenance tasks, from regular upkeep to emergency repairs. This isn’t just a financial cost—it’s also time and energy you’ll need to invest regularly. Some homeowners enjoy the involvement, while others find it a hassle.

3) Opportunity Cost

Consider where else your money could go: Buying a home means tying up a significant amount of capital. For some, this is a stable investment; for others, it may feel limiting. Think about what else you might be sacrificing. By purchasing a home, you’re potentially delaying investments in other areas like stocks, mutual funds, fixed deposits, or even higher-risk ventures like crypto (only kidding). Ensure this is a choice you feel confident in for your overall portfolio.

Hopefully, the above pointers give you some sense of how to think about your readiness to buy a home. Once you’ve decided you’re ready, what do you do next?

What Kind of Home Are You Looking For?

When buying a home, it’s essential to define what’s essential versus what’s merely desirable. Your must-haves are the non-negotiable features that cater to core needs, while nice-to-haves are additions that would enhance your experience if your budget allows.

1) Defining Your Must-Haves

Must-haves are the essential features that support your day-to-day life, aligning closely with your practical needs, lifestyle, and future plans. If these elements are missing, your satisfaction with the home could significantly decline.

- Location Specifics

- Location can make or break the experience of homeownership. It affects convenience, quality of life, and, in many cases, even your social connections. Ask yourself: Are you committed to a specific neighbourhood, or are you open to exploring areas with similar conveniences? I remember when I began my search, I knew I wanted to be close to work and within a short drive of my friends and favourite social spots. While I found several beautiful homes on the city outskirts, I had to remind myself that my must-haves were about minimising commute time and staying connected to my community. So, I prioritized compact homes in prime areas.

- Space and Layout Needs

- Your home should comfortably support the way you live, whether you’re single, have a growing family, or live with extended family members. Consider who will be living with you: Do you need additional rooms for parents, kids, or live-in help? How do you spend most of your time at home? Is a dedicated office or study area essential for your work or hobbies? How often do you have guests? Initially, I considered a charming two-bedroom flat, but with my parents staying with me often, I knew a third room would be non-negotiable. The extra room provided flexibility, allowing me to use it as a guest room or office as needed.

- Basic Amenities and Infrastructure

- Think about specific amenities that are part of your routine or lifestyle needs. For instance, if you enjoy daily swims or rely on gym facilities, having convenient access to these amenities can significantly enhance your quality of life. Ask yourself: Are there amenities (like a swimming pool or fitness centre) that are essential for your lifestyle? Swimming is a core part of my daily routine, so having a pool was a must-have for me. While browsing properties, I ruled out some lovely apartments simply because they didn’t have pool access. Ultimately, I found a complex with a pool, which justified a slightly higher price but kept my daily lifestyle intact.

2) Defining Your Nice-to-Haves

Nice-to-haves are features you’d appreciate but don’t absolutely need. These can add comfort or enjoyment to your experience and can help you prioritize properties that fit within your budget without compromising essential needs.

- Additional Features or Luxuries

- Nice-to-haves could include features like scenic views, high-end finishes, or smart home technology. Think of them as perks rather than requirements. Reflect on whether there are luxury features (like a balcony or high-end fixtures) that would enhance your experience but aren’t essential. If your budget allows, would you prefer a home with additional amenities, or would you invest in these upgrades over time?I came across an apartment with a spacious balcony overlooking a park, and while it was appealing, it wasn’t a deal-breaker. I realised that what I needed was a home office more than a scenic view. So, I ultimately chose a unit without a balcony but with an extra room that met my workspace needs.

- Outdoor Space or Proximity to Parks

- Outdoor spaces like balconies, terraces, or nearby parks can be attractive but aren’t always available in city apartments. If they’re nice-to-haves for you, they can serve as a tiebreaker between similar options. Consider how often you would use outdoor space like a balcony or terrace. Is it important to be close to parks or other recreational outdoor spaces, or can this be secondary to other priorities? One property had a cosy balcony, ideal for morning coffee. But when I compared it to another flat that offered a better layout and more storage, I decided that extra living space mattered more in the long run. Outdoor space was nice, but I could compromise if the essential features were in place.

- Future Flexibility

- Having a home with extra storage or adaptable spaces can be beneficial for future needs, but this flexibility isn’t critical for everyone. If it’s within your budget and fits other priorities, it’s worth considering. Will you likely need additional storage, a multipurpose room, or other adaptable features as your lifestyle evolves? Is there space that could be repurposed if your needs change, such as a spare room or study? I initially looked at properties with storage for long-term needs but realised that it wasn’t a must-have at this stage. Instead, I prioritised properties that had a dedicated workspace and good natural light. I decided I could find creative storage solutions if needed, as long as my must-haves were covered.

Requirements Checklist

- Gated community or individual building

- Ready to move in or under construction

- Floor plans and layout

- Number of bedrooms

- Size of apartment

- Kitchen layout

- Parking

- Work From Home - Dedicated Workspace or room

- Balcony

- Garden Space

- Gym

- Clubhouse

- Swimming Pool

- Extra Bedroom

- Old age accessibility

- Vastu compliance

- Proximity to schools

- Proximity to parks is crucial

- Proximity to Hospitals

- Proximity to Religious Places

A Note on Location

Location is one of the most critical factors to consider when buying a home, as it profoundly impacts your quality of life, convenience, and long-term satisfaction. Shortlisting specific areas can simplify your search and help you focus on properties that meet your lifestyle needs and preferences. Factors such as proximity to work, access to schools, and nearby amenities like parks and shops can significantly influence your daily routine. Here are a few other factors that can help you decide the ultimate location.

Evaluating Development and Growth Potential

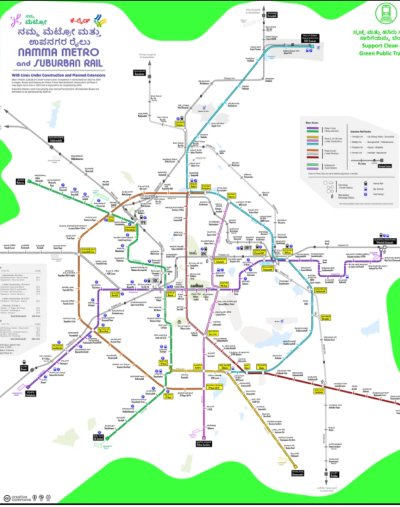

One of the main drivers of property value in Bangalore is infrastructure development. Investing in areas with planned metro stations, highways, or commercial centres can yield significant appreciation.

- Metro Expansions: The Namma Metro project expansion into areas like Whitefield, Electronic City, and North Bangalore will significantly improve connectivity. Early investment in these metro-linked areas often leads to higher resale value and rental yields.

- IT and Tech Parks: Areas like Manyata Tech Park in North Bangalore and ITPL in Whitefield bring steady demand for rental properties, making them ideal for investors. Proximity to tech hubs generally boosts property prices and sustains high rental demand.

- Government Initiatives: Special Economic Zones (SEZs) and aerospace parks, particularly around the airport and Devanahalli, are strategic developments attracting major corporates and driving demand for residential properties.

Proximity to Essentials

When evaluating a property, consider its access to essential services like hospitals, schools, and shopping centres. Properties with easy access to these facilities generally have higher demand and hold their value better. For instance:

- Proximity to where you currently live: If you understand the area, that's a good start, and drives comfort.

- Proximity to where you work: Tech businesses are typically located in South and East Bangalore. From HSR to Whitefield. Typically, you should look for localities that are 25-30 min drive away. Anything more than 1hr away might be a bit too much on a daily basis.

- Aspirational areas: Irrespective of where you work, maybe you like being in the thick of things. Areas like Indiranagar, Halasur and MG road might cater to such needs.

Shortlisting Properties & Site Visits

By now, you’ve figured out:

- Your preparedness

- Your budget

- Your must-haves and nice to haves

- Size of the apartment you’re looking for

- Locations you’re looking at for your next home

It’s now time to get to the fun stuff - actually researching properties, and arranging site visits.

Shortlisting Properties: Filtering to Find the Best

Think about shortlisting as refining your list to those properties with real potential. Begin with clear priorities in mind, like space, budget, and must-have features. Next, delve into online resources to cross-check against your priorities. Use property portals to explore details like floor plans, builder reputation, and neighbourhood insights. Aim to rule out properties that may have hidden compromises. “I found a beautiful apartment online, but multiple reviews mentioned water pressure issues and limited guest parking, so I ruled it out.”

This step saves you countless hours by focusing on real contenders. Be rigorous and ask questions: Is this within my budget after taxes and fees? Are essential services like hospitals, shops, and schools nearby?

Also speak to friends, family, colleagues who may be living in that area. That’ll give you more insight into the pros and cons of the area itself.

Top tip: Revisit your shortlist after a few days—taking a break often brings clarity on what truly meets your criteria.

Site Visits: Making Every Moment Count

Site visits are your chance to confirm and clarify. Start by visiting in daylight hours to observe natural lighting, layout, and surroundings. As you walk through, think practically: “Can I picture myself in this living space? Is the kitchen functional for everyday use?” Use a checklist to guide your evaluation of things like closet space, ventilation, and noise levels.

During the visit, don’t hesitate to ask questions directly to the sales team or building management. Important ones include: “What’s the maintenance fee and what does it cover?” “Are there any nearby construction projects planned?” You’ll also want to check on power backup, water availability etc.

Finally, take time to chat with current residents if possible. They can provide valuable insights on the neighbourhood and building issues that brochures and sales reps might skip. Remember, site visits should confirm that the space doesn’t just look good on paper—it has the functional comfort you need for daily life.

Some of this might not be possible if this property is under construction, and not yet ready. In many cases, properties are sold out even before the sample flat is ready. Think carefully if you’re comfortable with booking a space without even looking at a sample flat. If you’re not, it’s okay to wait, and buy either once the sample is ready and/ or during resale.

Top tip: If you’re visiting the property with a broker, please be careful. Brokers are often generic with their advice, and will rarely be brutally transparent. It’s key to read between the lines, and ask relevant questions repeatedly to get the right answers eg. Is this area flood prone? Is there a polluted lake nearby? The broker might say he’s unaware, or that there was a lake previously, but has now been filled up, and there is no chance of flooding. The problem with statements like this are that there is no certainty, and inspire very little confidence. This is one area where Propsoch can help - with data backed insights that go beyond opinions.

Site visits with the Propsoch team also help you get “off the record” insights on the property, builder and neighbourhood. We’ll also share our technical due diligence insights regarding ventilation, chances of flooding or any other risks associated with buying a home at said property.

Figuring out Home Loans & Interest Rates

Home Loans and Interest Rates

Understanding loan options and interest rates is critical to making a sound financial decision. Here’s what prospective homeowners need to know:

- Choosing Between Fixed-Rate and Adjustable-Rate Loans

- Fixed-Rate Loans: These loans offer stable monthly payments, ideal for those seeking consistency over the loan’s term. Fixed-rate loans shield you from market fluctuations and are generally better for those planning long-term ownership. It’s extremely rare for banks to offer this in today’s market. Most loans are likely to be floating interest rate.

- Floating-Rate Loans : In a floating rate loan, your interest rate is typically tied to RBI linked repo rate - though some banks may not link it to the repo rate. Always check with your bank if it’s linked to the repo rate. Secondly, these loans vary with the repo rate defined by the RBI (eg. interest rates have gone up from 5-6% to 8.5% in the last 3yrs). Based on the prevailing rate, your monthly EMI also changes.

- Loan Eligibility and Pre-Approval Process

- Eligibility Criteria: Most lenders assess eligibility based on income, employment stability, credit score, and debt-to-income ratio. If you meet these criteria, getting pre-approved gives you a clear picture of what you can afford and helps in competitive markets.

Making Visible All Hidden Costs

Beyond the purchase price, homeownership involves several additional costs. Budgeting for these “hidden” expenses is vital to avoid future financial strain:

- Closing Costs and Fees

- Title Registration and Legal Fees: In Bangalore, the stamp duty and registration charges for property transactions currently stand at approximately 5.6% for stamp duty and an additional 1% for registration fees with cess making a total of 6.72% of the property value for most property types.

- Broker Fees: Broker fees usually account for 1-3% of the property price. However, Propsoch’s zero-brokerage model allows buyers to skip this cost entirely, which could mean more flexibility for personalising the home or covering other expenses.

- Clubhouse and Amenities Charges: Many new developments include access to clubhouses, gyms, pools, and other facilities. These can come with one-time charges or ongoing monthly fees. Initial setup fees for these facilities typically range from ₹2 to ₹5 lakhs, depending on the project’s level of amenities.

- Infrastructure Charges: Infrastructure fees, often levied by developers, cover the cost of building roads, sewage systems, water connections, and other essential services within the property. This charge can vary but typically ranges from ₹75,000 to ₹5 lakhs, depending on the size of the property and the facilities offered.

- Maintenance Deposit: Some properties require an upfront maintenance deposit to cover the first 1-3 years of upkeep. This can be around ₹3 to ₹8 per square foot monthly, translating to a substantial upfront fee for larger homes.

- Parking Fees: Reserved parking spaces may not be included in the property’s base cost and can require a separate fee. Parking slots in prime areas or gated communities may cost between ₹1 lakh to ₹3 lakhs per slot.

- Interior and Fit-Out Costs: Although optional, buyers often overlook costs for interior work, including flooring, modular kitchens, wardrobes, and other fittings. Depending on the size and quality of materials, this can add anywhere from ₹5 lakhs to ₹20 lakhs or more. A good thumb rule is 10-15% of the property value.

- Miscellaneous Fees: These can include charges for utilities like water and electricity connection, property tax deposits, and various small administrative fees.

- Maintenance and Repair Costs

- Routine Maintenance: Owning a property involves upkeep, whether it's routine repairs, renovations, or ongoing improvements. Financial planners suggest setting aside 1% of your home’s value annually for maintenance. This can be routine maintenance, or the big renovation you undertake once every 5-10yrs. But assume 1% on average every year.

- Community Maintenance Charges: Apartments and gated communities in Bangalore charge maintenance fees that cover security, landscaping, and common area upkeep. Account for these costs as they can increase annually. These are generally charges basis the square footage of the house, and can vary from ₹5-15 per sqft based on the society and amenities offered.

- Property Taxes and Insurance

- Property Taxes: In Bangalore, property taxes vary based on property size, location, and type. Make sure to research the specific rates for your desired area as they are a yearly recurring expense.

- Home Insurance: Home insurance provides coverage against damage from natural disasters, fire, and theft. Look for comprehensive plans with competitive premiums that align with your budget.

Conducting Legal & Technical Due Diligence

Navigating the legal aspects of buying property in Bangalore requires careful verification to avoid potential pitfalls. Due diligence, when done thoroughly, helps secure your investment and prevent unforeseen complications.

Title and Ownership Verification

A clear title is essential for secure ownership. Confirm that the seller has complete ownership and authority to sell the property. This process often involves checking the Title Deed and prior ownership records. Hiring a legal expert to review these documents can reveal any existing liens, mortgages, or unresolved ownership disputes, ensuring you avoid future conflicts. For buyers using Propsoch’s services, advisors can guide you in obtaining the necessary documents and facilitate consultations with legal experts.

Regulatory Compliance

Properties in India must comply with various local and national regulations. Here’s a checklist to guide you through regulatory compliance:

- RERA Approval: RERA mandates transparency, and properties registered under RERA often come with fewer risks of delay or misrepresentation.

- Zoning and Land Use Laws: Ensure that the property complies with Bangalore’s Comprehensive Development Plan (CDP). This is crucial to confirm that the property’s usage aligns with city planning and zoning regulations.

- Building Plan Approval: Check that the layout plan and building permissions adhere to local laws. Deviations from approved layouts may lead to future demolition or hefty fines.

Propsoch’s advisors will have done this research, and can guide you on getting a legal opinion if you seek one.

Identifying Potential Red Flags

Due diligence goes beyond checking ownership and regulatory approvals; identifying red flags in the property’s surroundings is equally important. Here are areas to watch:

- Encumbrances: These can include outstanding loans or claims from third parties. An encumbrance certificate will reveal any existing financial liabilities attached to the property.

- Environmental Hazards: Bangalore’s monsoon rains occasionally cause flooding in certain areas. Check for flood-prone zones or poorly drained plots that could lead to waterlogging. Propsoch advisers can help you with this information.

- Proximity to High-Tension Power Lines: Properties near high-voltage lines not only face aesthetic drawbacks but can also present safety and resale challenges.

Obtaining Key Documentation

Certain legal documents can secure your investment and avoid future complications:

- Encumbrance Certificate (EC): This document shows that the property is free from legal or financial liabilities.

- Occupancy Certificate (OC): For ready-to-move properties, ensure an OC has been issued, confirming the building’s adherence to local codes.

- Sale Agreement: This document outlines the terms of the sale and safeguards the buyer’s rights, detailing conditions like payment terms, timelines, and more.

Engaging in comprehensive legal due diligence protects you from future disputes and enhances confidence in your investment. For further guidance, Propsoch offers resources to facilitate these checks, making the process smoother and more efficient.

Making an Offer and Finalising the Deal

Navigating the final steps of your home purchase, from making an offer to closing the deal, requires a clear strategy and attention to essential documents and fees. This stage ensures that your interests are well-represented and all legal and financial elements are securely handled.

Effective Negotiation Strategies

Negotiating effectively can significantly impact the final price and terms:

- Research Comparable Sales: Do a detailed price benchmarking across projects in the vicinity. Or speak to propsoch advisors to access our price benchmarking tools.

- Timing and Flexibility: If the seller is eager to close quickly, flexibility in move-in dates or payment timelines may work in your favour to secure a better price.

Completing due diligence on these documents protects your ownership rights and helps prevent any future disputes.

Understanding these costs in advance enables a smoother closing experience, ensuring all requirements are met without last-minute surprises.

Moving Forward with Confidence

Buying a home is more than a transaction; it’s a life-changing step that requires careful planning and informed choices. By thoughtfully assessing your readiness—both financially and emotionally—you set a foundation for success. Each step, from budgeting to property research, legal diligence, and long-term planning, empowers you to navigate Bangalore’s competitive real estate market with confidence.

This guide emphasises a structured approach: understanding market dynamics, evaluating properties based on personal and financial goals, and future-proofing your investment. Bangalore’s real estate is dynamic, with opportunities across emerging and established micro-markets. Whether you’re purchasing for stability, investment potential, or future growth, adhering to these steps helps ensure you make choices aligned with your aspirations.

With insights into local market trends, due diligence tips, and negotiation strategies, this guide equips you to secure a property that will grow in value and meet your evolving needs. As you embark on this journey, remember that each decision—rooted in thorough research and personal readiness—brings you closer to a fulfilling homeownership experience in one of India’s most promising cities.

At Propsoch, we are committed to guiding you every step of the way. With data-driven insights, expert advice, and local market knowledge, we help you make well-informed, confident decisions in Bangalore’s ever-evolving real estate market. Let us be your trusted partner on the journey to finding your ideal home.